A captive market, no competition and government contracts that make monopoly-enabled price gouging the industry standard — it’s never been in doubt that the prison phone business is a very profitable model.

A presentation that the privately-held prison telecom company Securus made to investors that The Huffington Post obtained shows just how much money there is to be made as the state-sanctioned middleman between prisoners and the outside world: $404.6 million last year alone.

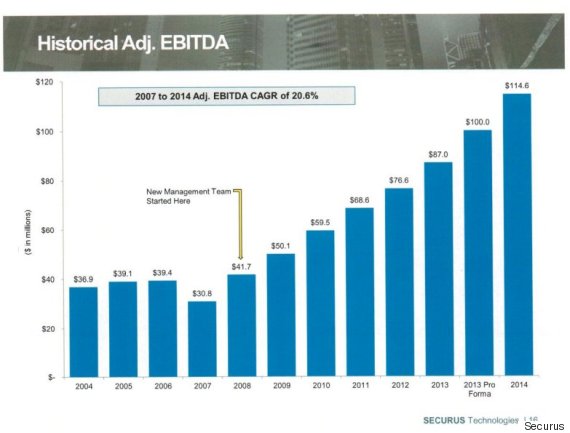

Securus, which provides phone services to 2,600 prisons and jails in 47 states, made $114.6 million in profit on that revenue in 2014. Securus’ gross profit margin — a measure of the difference between the cost to provide its services, and what it charges for them — was a whopping 51 percent. And Securus, with a 20 percent market share, isn’t even the biggest prison phone company. That would be Global Tel-Link, or GTL, which has a 50 percent market share, the New York Times reported. GTL drew national attention for its prominent role in the 2014 viral podcast Serial.

While Securus is already making massive profits off of prisoners and their families, they are also looking for other, faster-growing revenue streams. In an April 15 presentation to investors, the company sought $205 million in debt to fund its purchase of JPay, a telecommunications company that provides banking, electronic communication and entertainment to over a million prisoners in 29 states.

Buying JPay will allow Securus to move beyond the analog world of voice phone calls, and into faster-growing businesses like money transfers, email and video chat, and selling prison-approved tablets that allow inmates and families to purchase music and games. (Securus announced on April 14 that they had successfully reached an agreement to purchase JPay.)

Securus has already seen major earnings growth in recent years. When the current management team took over in 2008, earnings were at $41.7 million. Since then, they’ve grown roughly $10 million each year between 2008 and 2013. Profits soared between 2013 and 2014, jumping from $87 million to $114.6 million in a single year.

Securus and ABRY did not immediately respond to requests for comment. JPay declined to comment.

Like most acquisitions, it is also a boon for jargon: Securus notes that it is excited about the “cross-sell / up-sell opportunities (alongside combination cost-savings)” which will increase Securus’ “growth and broaden its revenue base.” More than most mergers, however, the jargon quickly becomes nauseatingly detached from the human reality of the business both companies are in — forcing prisoners to pay high rates to talk to family and friends, listen to music or play video games.

The acquisition is attractive, Securus says in the presentation, because the approximately $75 billion the U.S. spends annually on the entire corrections industry represents “a large, recession-resistant and stable market.” In the U.S., “inmate population and corrections expenditures,” the company notes, “have grown steadily for 3 decades.” By acquiring JPay, the company will be able to more fully exploit the business opportunity of mass incarceration, Securus leaders pitched: “The acquisition of JPay results in a comprehensive communication and tech-enabled solution provider” that is “well positioned for organic growth.”

Recent Comments